Contributors

Related Articles

Stay Up To Date

Something has gone wrong, check that all fields have been filled in correctly. If you have adblock, disable it.

The form was sent successfully

Modern slavery, including forced labor and human trafficking, continues to present significant and often hidden risks across global supply chains. For long-term investors, these risks are no longer peripheral—they can affect corporate strategy, regulatory exposure, and operational resilience. Through focused research and active ownership, we strive to spot red flags and help reduce issues within our portfolio businesses in an effort to secure long-term value for our clients.

Key Points

- Modern slavery is widespread across a diverse range of geographies, industries, and supply chains, often emerging in unexpected sectors with risks manifesting in both direct and indirect forms.

- Exploitative labor practices introduce substantial operational, reputational, legal, and regulatory risks that can handicap companies’ long-term growth and success.

- As active long-term investors, we are well positioned to identify and help reduce these risks through business-focused research and proactive engagement with our portfolio companies as part of our efforts to ensure long-term value creation for our shareholders.

In April 2013, the tragic collapse of Bangladesh’s Rana Plaza complex claimed the lives of more than 1,000 garment workers. The lethal consequences of unsafe working conditions drew global attention, including consumer boycotts of implicated apparel brands.1 Years later, allegations of forced labor at Boohoo’s U.K. garment factory led to a sharp decline in its share price and reputational standing as retailers pulled its products.2 These incidents highlight a recurring reality: labor exploitation, while a serious ethical issue, is also a material business risk that can erode consumer trust, impair a company’s reputation, and destroy shareholder value.

Dangerous and restrictive working conditions, exploitative wages, child labor, and human rights violations are often associated with the fashion industry, but these abuses extend far beyond apparel. Today, we see a wide range of modern slavery risks—from the extraction of raw materials to invisible forms of digital labor—across sectors. One prominent challenge for many of our portfolio businesses is the use of conflict minerals, such as tin, tantalum, tungsten, and gold (3TG), as well as cobalt. These materials are critical to the production of semiconductors, electronics, and batteries, but they are often sourced from high-risk regions where forced labor and weak governance are common. Elsewhere, in the race to employ artificial intelligence, companies have been criticized for relying on “ghost workers”—low-paid, often hidden contract workers performing essential but invisible tasks, such as labeling data and moderating content.3 These examples, and many more like them, reflect the breadth and complexity of slavery risks in today’s economy. Some scandals and abuses make headlines; others remain embedded in fragmented supply chains or hidden behind digital interfaces. Because such risks are harder to detect and address, they demand vigilance from companies and investors alike.

Labor exploitation, while a serious ethical issue, is also a material business risk that can erode consumer trust, impair a company’s reputation, and destroy shareholder value.

We recognize that the expansion of global supply chains over the past few decades has been a powerful engine of progress, helping to lift more than 1 billion people out of extreme poverty and bringing new markets, jobs, and technologies within reach.4 These are dynamics in which we seek to invest at Sands Capital. But the interconnected system that fuels growth and inclusion can also conceal risks deep within supply chains.

As an active investor with a long-term focus, we believe we have a responsibility to both capture the opportunities created by global trade and innovation and to engage with our companies to understand and discuss the potential impacts of their operations, including modern slavery. Being able to navigate the complexities of these risks is critical to our mission to add value and enhance the wealth of our clients with prudence over time.

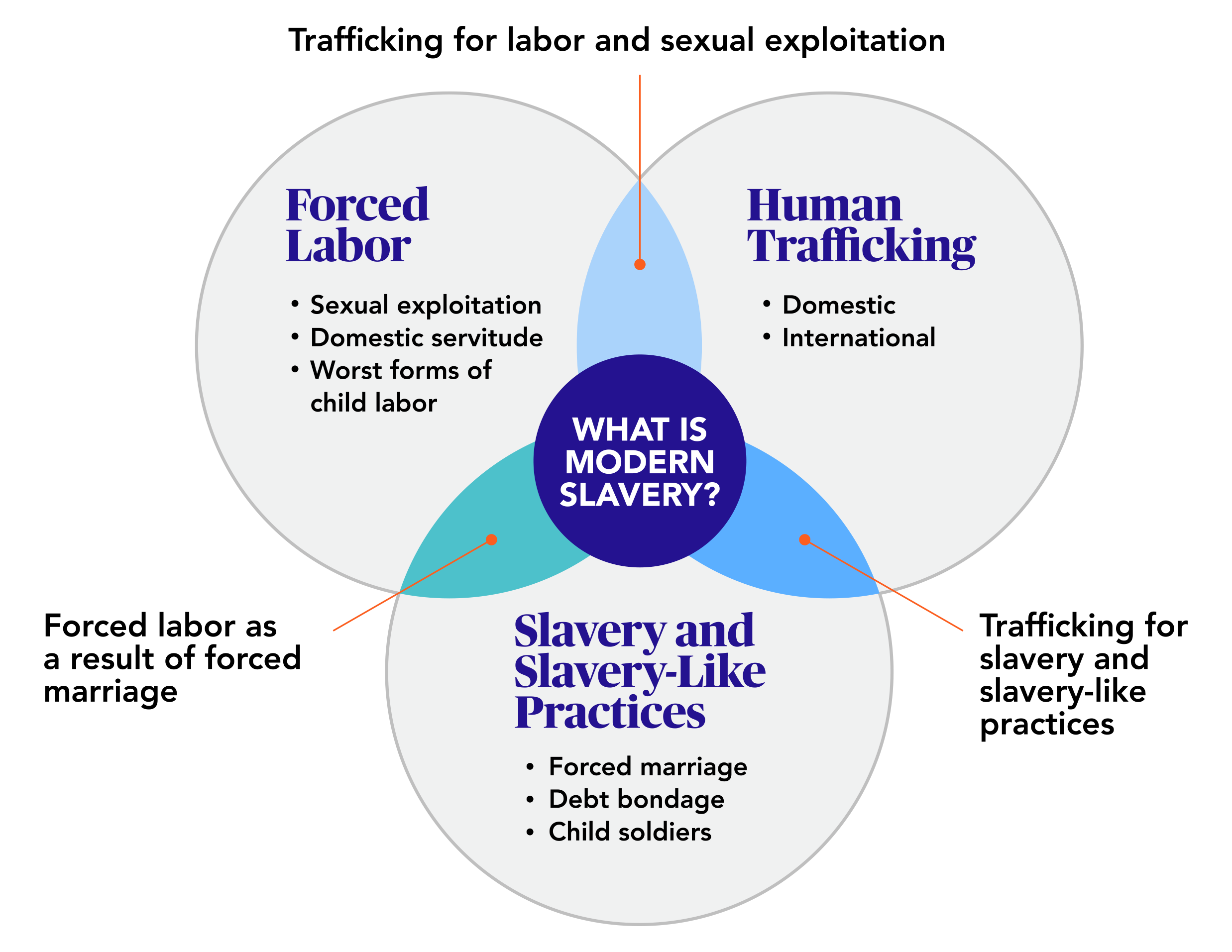

What Is Modern Slavery?

Exhibit 1

UNDERSTANDING THE COMPLEXITIES OF MODERN SLAVERY

The rise in modern slavery is fueled by a complex set of global dynamics. Globalization, widening inequality, climate-related displacement, political instability, and the lingering effects of the pandemic have intensified worker vulnerability and obscured certain abuses in supply chains. At the same time, enhanced data-collection efforts and increased scrutiny may have led to more cases being identified and reported.

In response, efforts to combat modern slavery are accelerating. Governments are introducing stronger due diligence legislation while nongovernmental and global organizations are spotlighting high-risk sectors and geographies through advocacy, investigations, and enhanced data collection. Civil society, media, and consumers are raising expectations for corporate accountability and transparency. Yet efforts remain fragmented and inconsistent, leaving a gap in which investors have a critical role to play.

The Risks to Long-Term Growth

Higher cost of capital and stymied growth: Companies accused of exposure to modern slavery could face increased scrutiny in their efforts to pursue additional growth opportunities and market presence. Shein, a China-based fast-fashion retailer, is just one example. After U.S. lawmakers raised concerns about potential links to Uyghur forced labor, Shein abandoned its planned U.S. initial public offering and instead pursued a listing in London, where it continues to face regulatory challenges and opposition from anti-slavery activists.6

Investors are also integrating human rights considerations into their risk assessments, prioritizing companies with a demonstrated commitment to responsible business practices while avoiding those exposed to forced labor. Declines in share price and diminished investor confidence can limit access to capital. Norges Bank Investment Management, which oversees Norway’s $1.7 trillion sovereign wealth fund, has divested from dozens of companies over human rights concerns, including 15 in 2024 alone.7

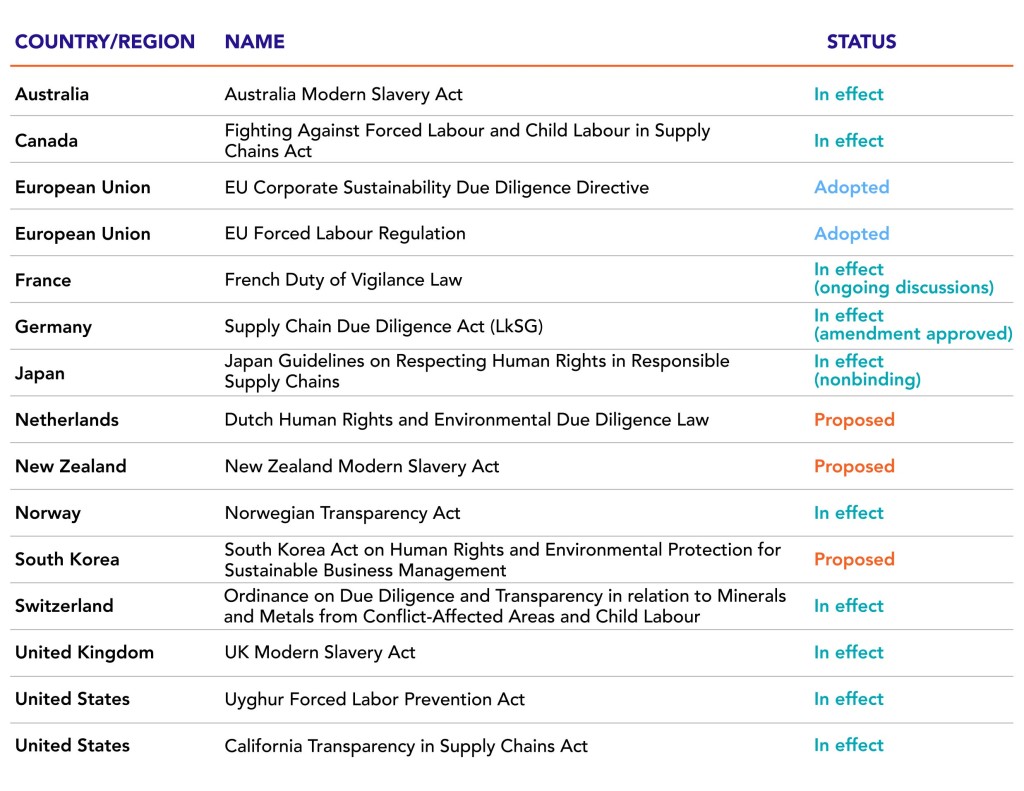

Regulatory risks and compliance pressures: Governments worldwide are enacting stricter labor laws and supply chain diligence requirements to combat modern slavery. Recent regulations have required companies to implement measures such as supply chain audits, enhance documentation and reporting standards, and implement third-party risk management protocols. Failure to comply can result in fines, legal sanctions, import bans, and restricted market access.

Exhibit 2

REGULATIONS TAKING EFFECT AROUND THE WORLD

Operational disruptions and supply chain risks: For many companies, incidents of modern slavery can mean costly supply chain diligence and restructuring, supplier renegotiations, and logistical challenges. Industries that rely on low-cost labor or high-risk materials are particularly exposed, as forced-labor concerns can lead to product bans, contract terminations, and production slowdowns.

Industries reliant on critical minerals—such as cobalt and 3TG metals used in electronics and electric vehicle batteries—have faced mounting scrutiny over labor conditions in their supply chains, often resulting in disruptions and increased compliance costs.

Beyond the technology sector, the United States implemented the Uyghur Forced Labor Prevention Act (UFLPA) in 2022, banning imports made wholly or partly in China’s Xinjiang region due to concerns about forced labor.8 Companies relying on Xinjiang cotton were forced to find alternative sources, often disrupting operations. Patagonia, for example, stopped sourcing cotton from China in 2020 and restructured its supply chain.9 While Patagonia’s decision preceded the UFLPA, it illustrates the kind of operational disruption such transitions can entail. Patagonia has since adopted isotopic testing to verify the geographic origin of its cotton and ensure compliance with U.S. regulations.10

Customer backlash and reputational damage: In addition to financial and regulatory pressures, many consumers in today’s interconnected world are both more informed and more vocal about their values, demanding accountability and transparency from the companies they support. Brands linked to modern slavery scandals not only face reputational damage but also risk losing customers.11

Such a consumer backlash and erosion of trust can lead to significant sales declines, which may have a negative impact on a company’s share price and overall market standing. Boohoo’s scandal is a prominent example, but scrutiny has extended to food and beauty companies as well. Starbucks has faced lawsuits over allegedly using coffee from farms that employed child and forced labor while Estée Lauder and L’Oréal12 have been investigated for sourcing from farms using child labor.13

The Imperative for Active Investment Management

Modern slavery is not only a moral and human rights concern; it is also a systemic business risk that intersects with broader structural themes, from supply chain resilience and geopolitical volatility to demographic shifts and digital transformation. These risks underscore why investors cannot remain passive, and why active managers with long-term, concentrated strategies are particularly well positioned to help their portfolio companies address the risks and concerns they encounter.

At Sands Capital, we practice active ownership through engagement and proxy voting, grounded in the deep research of our investment team. We believe our analysts are well positioned to assess both the current operations and ongoing evolution of our portfolio companies. Their company expertise and trusted relationships with management teams position them to surface vulnerabilities, including exposure to modern slavery, and to recommend stronger oversight and more resilient business practices.

To reinforce this work, our stewardship team partners with analysts to embed modern slavery risk assessments into the investment research process and to structure informed, constructive dialogues with company leadership. As part of this effort, we have partnered with Slave-Free Alliance (SFA), whose support goes beyond training to include strengthening our due diligence frameworks, developing specialized tools, and sharing best practices to enhance our ability to identify and reduce modern slavery risks.

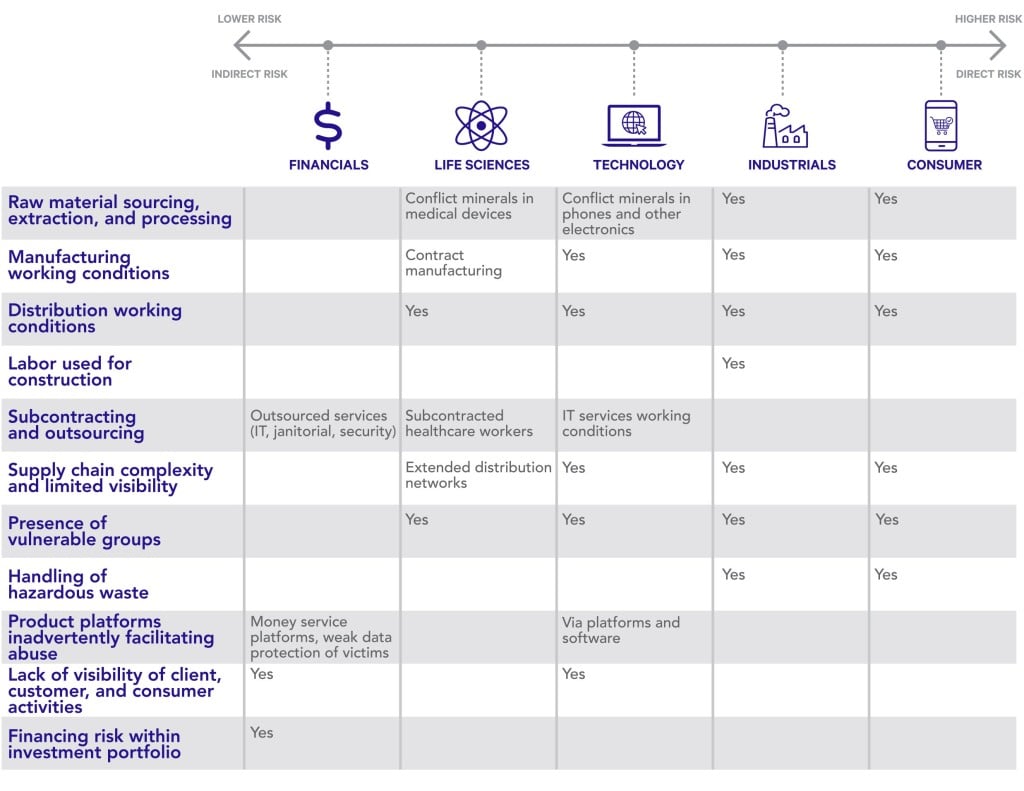

Navigating Risks Across Industries

Modern slavery risks can affect any company, supply chain, or sector. However, these risks may manifest differently across industries in our investment portfolio due to the varied nature of operations.

Direct risks are tied to a company’s core operations or supply chains. They are typically more immediate and observable, requiring robust reduction strategies, such as supplier due diligence, regular audits, and worker-grievance mechanisms.

Indirect risks can emerge through second-tier suppliers, third-party service providers, product use, or financing. These risks may be compounded by flawed practices, such as weak “Know Your Customer” procedures or failure to monitor financial transactions for links to exploitative activity. Addressing these risks often requires stronger traceability, thorough supplier risk assessments, and oversight mechanisms across the extended value chain.

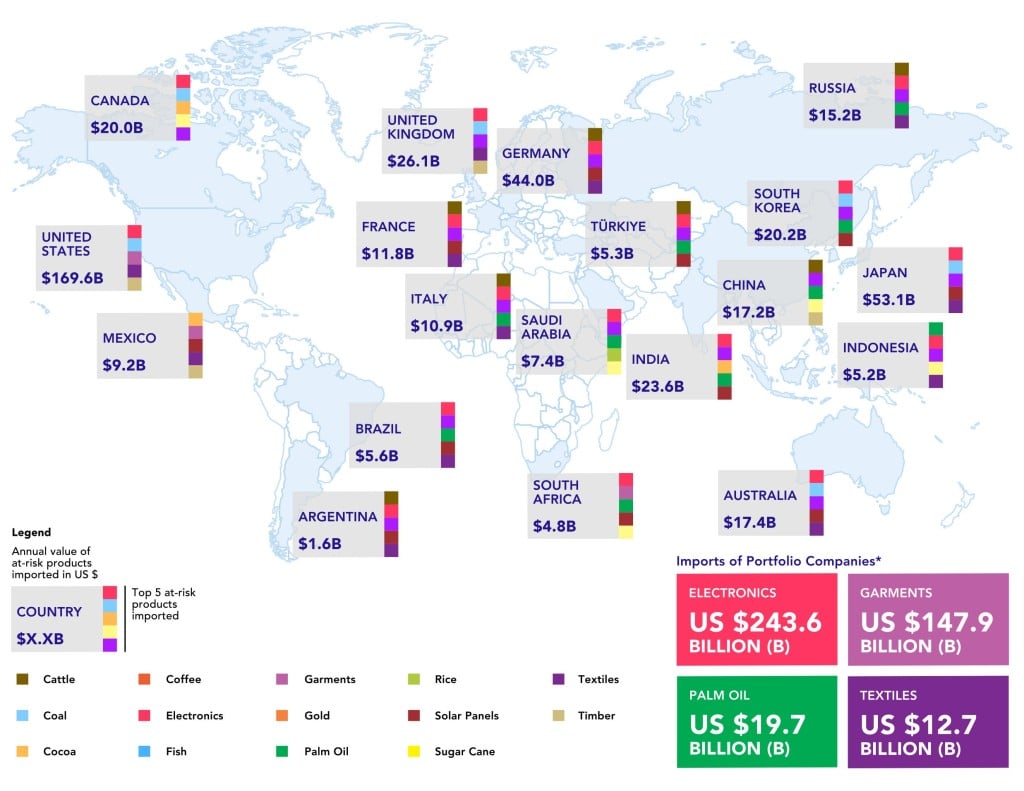

Exhibit 3

UNCOVERING THE RISKS ACROSS INDUSTRIES

The 2023 Global Slavery Index revealed that nearly two-thirds of forced labor cases are linked to global supply chains, with exploitation occurring across a vast range of industries and at every stage of the supply chain.14 Most of this forced labor is concentrated in the early stages, such as the extraction of raw materials and production stages.

According to this data from Walk Free, the industrialized and emerging market countries of the G20 import more than $468 billion annually in goods at risk of being produced with forced labor—an inflation-adjusted increase of $61 billion since 2018. Top categories include electronics, garments, palm oil, solar panels, and textiles, many of which feature in our portfolio companies’ supply chains.15

Exhibit 4

MODERN SLAVERY RISKS SPAN GLOBAL SUPPLY CHAINS AND INDUSTRIES

Consumer and Industrials

Companies in the consumer and industrials industries may face greater and more direct risks. These risks often stem from the sourcing, extraction, and processing of raw materials, which can negatively affect local communities, especially in countries with less stringent labor laws. Additionally, the complexities of supply chains in these sectors—such as the involvement of multiple layers of suppliers and partners spread across various regions and countries—make it challenging to monitor and enforce ethical labor standards.

For instance, labor used at various stages of the clothing supply chain, as well as agricultural work within food supply chains, can often involve dangerous practices. Similarly, labor used in construction and manufacturing is often subjected to harsh working conditions. Exploitation risks, such as forced overtime, restricted movement, and withheld wages, exist within all these fields, as they often hire members of vulnerable populations. These include women, children, and migrants, who may lack the power or resources to defend their rights or leave their employment situation.16

Recognizing these challenges, we engage with portfolio companies in industries such as textiles to help ensure they understand these risks and the ethical standards we encourage. Our goal is to collaborate with management teams to drive sustainable improvements in supply chain practices and support a long-term perspective.

For instance, Anta Sports Products, China’s largest domestic sportswear company, has faced international scrutiny for its continued sourcing of cotton from the Xinjiang region, where the use of forced labor involving ethnic minorities has been widely alleged. After withdrawing from the Better Cotton Initiative (BCI) in 2021, citing political sensitivities, Anta reaffirmed its intention to continue sourcing Xinjiang cotton in line with its internal standards. This decision drew global criticism and intensified reputational risk, prompting a series of engagements on our part to understand the company’s position and encourage stronger supply chain governance.

We have engaged extensively with Anta’s leadership over the past several years, including repeated conversations with senior management and a meeting with the company’s founder. Early on, we made strong recommendations to adopt third-party supplier audits and improve transparency. Since then, Anta has made notable progress. It began third-party audits in 2021, assessed more than 150 suppliers in 2024, and established a supply chain risk group within its procurement team to conduct internal audits. Its 2024 ESG Report disclosed audits of 786 suppliers across Tiers 1, 2, and 3 with corrective actions where needed, which was a significant increase in audit volume and third-party participation. This reflects a significant year-over-year increase in both the overall audit volume and the number of third-party assessments. The company is also exploring partnerships with external certifiers to validate its cotton sourcing, though it faces challenges identifying auditors willing to operate in Xinjiang.

As part of our broader diligence approach, analysts across the investment team participate in training with SFA to strengthen their ability to spot potential red flags during site visits, such as impromptu checks of cafeterias and restrooms to evaluate general workplace conditions. This training not only helps identify risks of forced labor but also equips our team with practical tools to assess worker wellbeing and health and safety, allowing our investment team to conduct a more rigorous visit to Anta’s manufacturing site in 2023. While no immediate concerns were observed during that visit, the exercise highlighted how we apply this training to better understand on-the-ground realities.

As active investors, we believe we have a responsibility to engage with our companies to understand and discuss the potential impacts of their operations, including modern slavery.

In 2024, Anta facilitated a sustainability-themed investor tour in China that included site visits and meetings with company leadership. While we were unable to attend, we reviewed several reports from the event that pointed to continued progress on supply chain transparency and cotton traceability. Taken together, these developments and our own engagement underscore that Anta is on a journey—still catching up to global best practices on human rights while navigating the realities of geopolitics and its domestic operating environment. We will continue to advocate for increased traceability, regular third-party audits, and alignment with international labor standards. We believe the company is committed to tackling the challenges ahead.

Similar supply chain challenges exist in the food sector, where India’s sugar industry stands out as a particularly fragmented and opaque system in which exploitative labor practices are deeply entrenched and difficult to trace. Following New York Times investigative reports throughout 2024 about widespread abuses in Maharashtra, we engaged directly with Britannia, a leading Indian food products company, to understand its sourcing practices and oversight approach.

The company was open to dialogue and expressed a willingness to explore collaborative efforts to strengthen supply chain accountability. While Britannia shared that it aims to avoid sourcing from mills with known violations, it acknowledged that a small volume had been indirectly procured from a flagged mill through intermediary traders. This occurrence underscores the limitations of indirect sourcing models.

Recognizing the structural nature of the issue, we followed up with a formal letter outlining a phased roadmap for improvement. Our recommendations ranged from near-term actions, such as independent audits and supplier mapping, to longer-term efforts, such as grievance mechanisms and broader industry collaboration. To support the conversation, we shared case studies from the Mexican sugar industry and West Africa’s cocoa sector that demonstrate how direct engagement and capacity building can improve labor conditions over time.

Addressing risks of this scale requires patient, strategic engagement and a shared commitment to building more transparent and resilient sourcing systems.

Technology, Life Sciences, and Financials

In addition to more visible risks, such as the widespread use of conflict minerals, human rights risks in the technology, life sciences, and financials sectors can also manifest in less obvious ways. Asset-light business models may still face significant exposure through hidden forms of exploitation, making such risks harder to detect but no less damaging.

Technology and life sciences companies navigate both direct and indirect risks. Similar to the industrials and consumer sectors, they face complex and opaque supply chains that can obscure labor abuses.

Minerals—especially 3TG and cobalt—that are essential for manufacturing items such as semiconductors or advanced medical devices often come from mines in regions plagued by dangerous conditions, low wages, child labor, and human rights violations. Despite regulatory advances, such as the Dodd-Frank Act in the United States—which requires public companies to disclose their use of conflict minerals—supply chain traceability remains extremely difficult. Many companies rely on supplier self-reporting and standardized disclosure tools, such as the Organization for Economic Cooperation and Development-aligned Conflict Minerals Reporting Template (CMRT), to gather information on the origin of minerals and assess whether they may be sourced from conflict-affected or high-risk areas. While these tools support responsible sourcing efforts, they depend heavily on supplier declarations and are not independently verified. As a result, disclosures are often incomplete, inconsistent, or difficult to validate—making it challenging for companies to fully assess the origin and ethical integrity of the minerals used in their products.

We recognize that investors, too, face limitations when it comes to addressing mineral sourcing risks. We don’t control supplier contracts or sourcing decisions, and we’re several steps removed from the people most vulnerable to abuse. Still, we use our position to evaluate how companies handle these challenges. Do they map their supply chains? Participate in third-party audits? Follow up on incomplete reporting? Do they set clear expectations around sourcing standards—and enforce them?

We began engaging more systematically on conflict minerals in 2021, after signing a Principles for Responsible Investment-led investor letter targeting the semiconductor sector. Since then, we’ve expanded our focus to include other industries in which mineral sourcing risks are high. We have organized a series of expert calls to deepen our understanding of mineral sourcing risks and developed a critical minerals due diligence resource, which we released internally in 2025.

Our engagement with Dexcom highlighted both progress and persistent challenges in responsible sourcing. A global leader in glucose monitoring systems, Dexcom relies on electronic components that contain conflict minerals such as 3TG. In 2024, we spoke with the company to understand how it mitigates sourcing risks. We found that Dexcom has implemented several best-practice measures: it files a Conflict Minerals Report under U.S. regulation, conducts country-of-origin inquiries to flag high-risk sourcing, and uses the CMRT through a third-party compliance platform. Notably, the company achieved a 99 percent supplier response rate and follows up directly when data is missing or inconsistent.

We discussed the traceability challenges Dexcom faces and asked how it plans to improve supplier transparency. While the company has formed an internal working group to monitor supply chain risks, it has not yet adopted new technologies to enhance traceability beyond Tier 1 and Tier 2 suppliers.

Notably, Dexcom made progress during the year. In our August 2025 follow-up, the company shared that it has strengthened its oversight by joining the Responsible Business Alliance (RBA) and the Responsible Minerals Initiative (RMI). Furthermore, it is piloting facility-level traceability checks in its newly expanded manufacturing operations in Malaysia to ensure local suppliers meet its global due diligence expectations. Upon successful implementation, this approach will be applied to forthcoming facilities, including the new Ireland site scheduled to go live within the coming year.

A more recent challenge faced by technology companies has appeared with the advent of gig workers—freelance or contract workers who perform short-term tasks, such as food delivery or ride-hailing services—through digital platforms. These workers often lack job security and labor protections.17 Healthcare facilities also operate through extended distribution networks and numerous subcontractors. These realities may make workers more vulnerable and make it challenging to monitor and prevent exploitative practices.18

We’ve engaged with Uber Technologies, the world’s leading mobility technology platform by market share, to understand how it addresses risks associated with underage workers using its food-delivery platform. We proactively began discussions after the media reported that food-delivery companies were using underage couriers who had accessed accounts that were rented or sold by registered couriers, exploiting a provision in U.K. employment law known as the “right to substitute.” Such reports raised concerns about potential labor exploitation and the ineffectiveness of Uber’s safeguards to prevent unauthorized account sharing, especially in alleged cases of child labor.

During our engagements, Uber explained that it requires delivery partners to verify their age and identity, with real-time selfie checks used to detect account sharing. If account sharing is detected, the account will be deactivated. In response to the nuances of U.K. law, Uber’s U.K.-specific policies mandate that any substitutes must meet strict criteria, including being at least 18 years old and having the right to work in the U.K. In a subsequent engagement, Uber explained that it is collaborating with government authorities and other industry peers, such as Deliveroo and Just Eat, to address these challenges collectively. While this remains a developing issue, we believe our engagements have helped provide valuable insights into Uber’s proactive efforts to enhance platform security and prevent unauthorized account use.

News that a Chinese security guard was tricked into slavery by responding to a posting on a recruiting site sparked our engagement with Kanzhun, the operator of BOSS Zhipin, which is China’s largest online recruiting service provider. Even though this alleged incident did not happen through BOSS Zhipin, we recognized that blue-collar job seekers are particularly vulnerable to such exploitation, so we discussed with Kanzhun the importance of enhancing platform security and verifying job listings to prevent similar tragedies. Kanzhun told us its staff members physically verify the legitimacy of employers, their true hiring needs, and the accuracy of their job descriptions. The company has rolled out on-the-ground security investigation teams to 50 cities, which we believe is critical to protect blue-collar workers from fake online job postings.

The financials sector more often contends with indirect risks. Outsourced services, such as facilities management, janitorial services, security, or information technology support, introduce vulnerabilities that can inadvertently facilitate labor exploitation. Additionally, financial transactions and money service platforms can unknowingly finance and support businesses involved in unethical practices by using disguised payment methods, such as cryptocurrencies or direct payments through peer-to-peer (P2P) payment platforms. This risk underscores the need for enhanced data governance measures and ethical oversight across all facets of financial operations.

To better understand the risks that our fintech businesses face, we have consulted with Polaris, an anti-human trafficking organization. Through these discussions, we learned that traffickers were increasingly using P2P payment apps to facilitate illicit activities. Polaris discussed its efforts to connect with certain P2P providers, including Block’s Cash App, to establish collaborative solutions. Recognizing our positive relationship with Block, a portfolio company, we took advantage of the opportunity to connect Polaris with the right contacts at Block to exchange insights on red-flag indicators and potential solutions.

Although this engagement was not driven by any specific compliance concern at Block, it illustrates Sands Capital’s commitment to leveraging partnerships and sharing knowledge to address potential risks. By fostering dialogue between Polaris and Block, we aimed to encourage proactive measures across the fintech sector to detect and deter such activities, which we believe can help safeguard vulnerable populations and promote ethical business practices.

Looking Forward

We believe we have made meaningful progress in understanding and addressing modern slavery risks, yet we recognize that there is still much work ahead. We have developed an investment due-diligence guide focused on modern slavery issues and created a comprehensive portfolio risk radar to better understand significant human rights risks within our holdings. In addition, we published an internal guide for due diligence that focuses on responsible mineral sourcing to address the growing demand for critical minerals, some of which are classified as conflict minerals. The guide focuses primarily on the advanced, technology-driven industries shaping the future—such as semiconductors, medical technology, electric vehicles, and the energy transition.

As we continue to increase our knowledge, we believe we will be better positioned to guide our portfolio companies toward practices that help reduce these risks. In doing so, we aim to contribute to the broader fight against modern slavery, underscoring our dedication to responsible investment practices and our belief in the power of knowledge to drive positive change. We hope that this enhanced understanding will guide our research and engagement efforts, enabling us to concentrate our initiatives both on industry-specific topics and on idiosyncratic company-specific risks, thereby helping to ensure sustainable and ethical growth across our investments.

1 https://www.theguardian.com/commentisfree/2014/apr/24/boycotted-primark-rana-plaza-ethical-wardrobe

3 https://time.com/6247678/openai-chatgpt-kenya-workers/

5 https://www.walkfree.org/global-slavery-index/map/#mode=data

8 https://www.cbp.gov/trade/forced-labor/UFLPA

9 https://fortune.com/2021/07/18/china-cotton-forced-labor-xinjiang/

11 https://www.humanrights.dk/files/media/document/Rapport_DoingWell_tilg%C3%A6ngelig.pdf

13 https://knowthechain.org/wp-content/uploads/KTC-2023-FB-Benchmark-Report-Oct-23.pdf

14 The Global Slavery Index was designed to shed light on the extent of modern slavery and level of vulnerability to modern slavery for 160 countries, as well as the actions taken by 176 governments to address these crimes and human rights violations.

15 https://www.walkfree.org/global-slavery-index/findings/importing-risk

16 https://knowthechain.org/wp-content/uploads/KTC-2023-FB-Benchmark-Report-Oct-23.pdf; https://humantraffickingsearch.org/resource/the-sustainable-development-case-for-ending-modern-slavery/

18 https://pmc.ncbi.nlm.nih.gov/articles/PMC11067307/

19 https://www.fatf-gafi.org/en/publications/Fatfrecommendations/Guidance-rba-virtual-assets-2021.html

Disclosures:

The views expressed are the opinion of Sands Capital and are not intended as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell any securities. The views expressed were current as of the date indicated and are subject to change.

This material may contain forward-looking statements, which are subject to uncertainty and contingencies outside of Sands Capital’s control. Readers should not place undue reliance upon these forward-looking statements. There is no guarantee that Sands Capital will meet its stated goals. Past performance is not indicative of future results.

All investments are subject to market risk, including the possible loss of principal. Recent tariff announcements may add to this risk, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance.

As of September 10, 2025, Anta, Block, and Britannia were held across Sands Capital strategies. The companies were selected because they are among those with which we engaged about modern slavery. Companies referenced and not held in Sand Capital portfolios were used for illustrative purposes only. Kanzhun/Boss Zhipin, and Uber Technologies are no longer held in Sands Capital strategies as of the publication date. However, we include them as examples based on engagements that occurred during our ownership period. These engagements remain relevant to illustrating our approach to identifying and addressing modern slavery risks. Kanzhun was initially purchased in June 2021 and Uber in February 2020 across different strategies. Both companies were exited during the second quarter of 2025 and were selected by the authors on an objective basis to reflect Sands Capital’s historical stewardship efforts. Their inclusion does not represent a current investment recommendation and should not be interpreted as indicative of future holdings or investment intent.

The specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. There is no assurance that any securities discussed will remain in the portfolio or that securities sold have not been repurchased. You should not assume that any investment is or will be profitable. A full list of public portfolio holdings, including their purchase dates, is available here.

As part of our ongoing research, Sands Capital regularly engages with the management teams and, if appropriate, board members of portfolio businesses to better understand each business’s long-term strategic vision and management of risks and opportunities, including those pertaining to environmental, social, and governance (ESG) matters. Sands Capital’s engagement with management teams and board members does not involve any direct or indirect attempt to exert pressure to implement specific measures, change policies, or otherwise influence control over the issuer. The companies illustrated represent a subset of current holdings in the portfolio and were selected by the authors on an objective basis to illustrate the views expressed in the commentary. These examples were selected based on the recent date of the engagements and topics discussed. The assessment of each business is based on factors that we believe are material to the long-term investment case. To receive a complete list of company engagements for the prior twelve months please contact a member of the Client Relations Team at 703-562-4000.

References to “we,” “us,” “our,” and “Sands Capital” refer collectively to Sands Capital Management, LLC, which provides investment advisory services with respect to Sands Capital’s public market investment strategies, and Sands Capital Alternatives, LLC, which provides investment advisory services with respect to Sands Capital’s private market investment strategies, which are available only to qualified investors. As the context requires, the term “Sands Capital” may refer to such entities individually or collectively. As of October 1, 2021, the firm was redefined to be the combination of Sands Capital Management, LLC, and Sands Capital Alternatives, LLC (previously known as Sands Capital Ventures, LLC). The two investment advisers are combined to be one firm and are doing business as Sands Capital. Sands Capital operates as a distinct business organization, retains discretion over the assets between the two registered investment advisers, and has autonomy over the total investment decision-making process.

Information contained herein may be based on, or derived from, information provided by third parties. The accuracy of such information has not been independently verified and cannot be guaranteed. The information in this document speaks as of the date of this document or such earlier date as set out herein or as the context may require and may be subject to updating, completion, revision, and amendment. There will be no obligation to update any of the information or correct any inaccuracies contained herein.

This communication is for informational purposes only and does not constitute an offer, invitation, or recommendation to buy, sell, subscribe for, or issue any securities. The material is based on information that we consider correct, and any estimates, opinions, conclusions, or recommendations contained in this communication are reasonably held or made at the time of compilation. However, no warranty is made as to the accuracy or reliability of any estimates, opinions, conclusions, or recommendations. It should not be construed as investment, legal, or tax advice and may not be reproduced or distributed to any person.

Risks Associated with Sands Capital’s Approach to ESG: Application of Sands Capital’s ESG process may affect the Fund’s exposure to certain issuers, sectors, regions, and countries and may affect the Fund’s performance depending on whether certain investments are in or out of favor. Sands Capital’s ESG process (including adherence to any exclusion criteria) may result in the Fund forgoing opportunities to buy certain securities when it might otherwise be advantageous to do so or selling securities for ESG reasons when it might be otherwise disadvantageous for it to do so. As a result, the Fund’s performance may at times be better or worse than the performance of funds that do not use ESG or sustainability criteria. There are significant differences in interpretations of what it means for an issuer to have positive ESG factors. The portfolio decisions Sands Capital makes may differ with other investors’ or advisers’ views. Socially responsible norms differ by country and region, and an issuer’s ESG factors or Sands Capital’s assessment of such may change over time. Sands Capital’s assessment of a company’s ESG factors could vary over time to reflect changes in a company’s performance, which could mean that a company could move from being an investment of the Fund to being divested due to ESG concerns, or conversely change from being previously considered not suitable for investment, to becoming investable. Where companies are subsequently considered not investable for ESG reasons, there may be a delay such that the Fund is temporarily invested in such companies as Sands Capital seeks to execute the transactions in an orderly manner to minimize the impact on the Fund. When conducting its ESG process (including compiling and maintaining any exclusion list), Sands Capital will rely on data obtained through voluntary or third-party reporting that may be incomplete, inaccurate, estimated, or unavailable, which could cause Sands Capital to incorrectly assess an issuer’s business practices with respect to ESG or to incorrectly include or exclude an issuer on or from any exclusion list. ESG data from data providers used by Sands Capital often lacks standardization, consistency, and transparency, and for certain issuers and guarantors, such data, including ESG ratings and scores, may not be available, complete or accurate or may be estimated.

Notice for non-US Investors.