Related Articles

Key Points

- Europe’s economic maturity, GDP stagnation, and challenging demographics belies a rich ecosystem of innovative, entrepreneurial, dynamic growth businesses that defy macro generalizations.

- The European opportunity set for growth investors is shallower than other geographies, but no less high-quality when viewed through a bottom-up lens.

- With increasingly supportive policy tailwinds and historically attractive relative valuations, Europe offers compelling long-term opportunities for growth investors willing to selectively focus on niche areas of a wider opportunity set.

In a remote Norwegian fjord, where the icy waters of the North Atlantic churn relentlessly, thousands of salmon swim in carefully monitored aquaculture pens. For decades, Salmar, one of the world’s largest salmon producers, has been perfecting the balance between sustainability, innovation, and growth. Once considered a niche industry, sustainable aquaculture is becoming a cultural aspect of the global transformation in food production. With increasing consumer demand for protein-rich, environmentally responsible food options—and Europe’s deep-rooted policy and cultural commitment to sustainability—we believe companies, such as Salmar are well positioned to thrive.

Salmar’s story reflects a broader narrative unfolding across European markets. For decades, investors have viewed Europe primarily through a top-down lens—an amalgamation of mature economies grappling with demographic headwinds, political fragmentation, and constrained fiscal flexibility. But that story is changing. Today, Europe is not one homogenous story; it is a rich mosaic of distinct geographies, regulatory frameworks, and capital market structures. Within this complexity lies an abundance of entrepreneurial dynamism, sectoral leadership, and globally competitive businesses that defy the limitations of regional averages and macro-driven generalizations.

The reality is that Europe is home to many of the world’s most resilient, high-quality, and forward-looking companies. These firms—often deeply rooted in their local markets—combine technical depth, capital discipline, and operational excellence with global ambition. Many are market leaders in specialized domains, including industrial automation, precision manufacturing, life sciences, and luxury consumer goods. What they often share is a culture of measured risk-taking, conservative balance sheet management, and an emphasis on long-term reinvestment. These attributes may not generate headlines, but they contribute to structural growth and compounding returns over time.

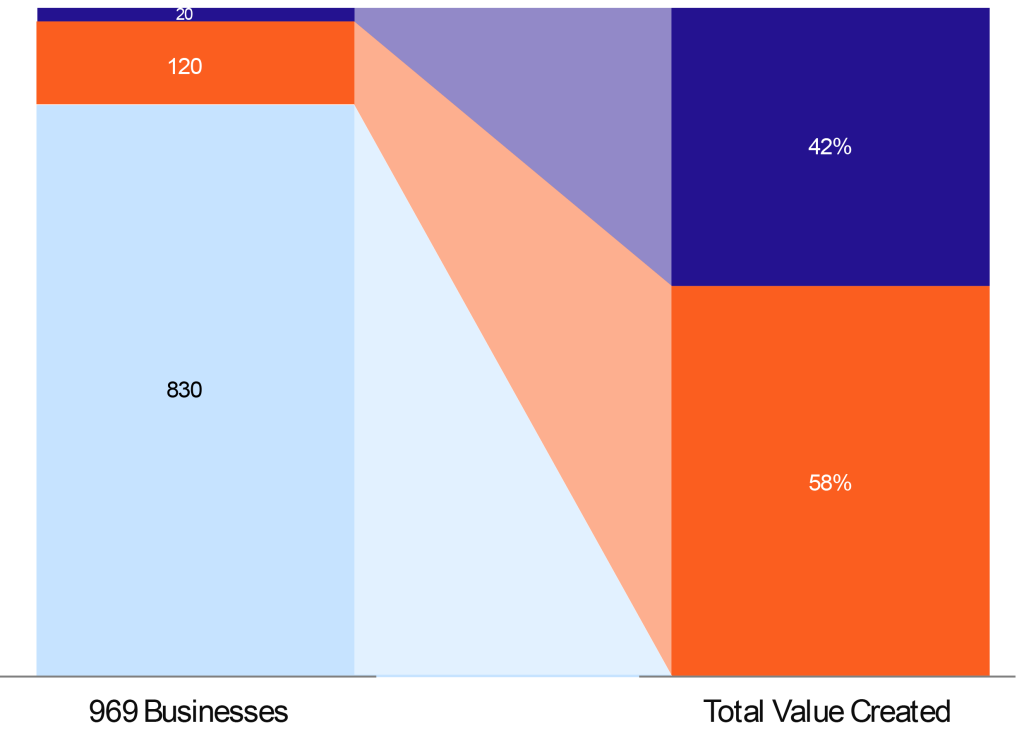

A SMALL NUMBER OF BUSINESSES GENERATE THE GREATEST WEALTH

Twenty businesses created 42 percent of MSCI Europe Index total value

Macroeconomic Winds Lend Support

Europe’s companies have been enjoying a bit of a tailwind of late, buoyed by a macroeconomy slightly more supportive of long-term growth. However, that could come to an end if trade tensions with the United States and tariffs curb the current expansion. To date, the European Central Bank’s measured approach to rate hikes has helped stabilize financing conditions while inflation begins to moderate. At the same time, the €750 billion NextGenerationEU recovery fund is accelerating investment in green infrastructure, digitalization, and healthcare—priority sectors for growth equity investors. Labor markets remain resilient, and fiscal stimulus continues to channel capital into innovation and sustainability, reinforcing Europe’s pivot toward strategic autonomy in areas such as semiconductors, energy, and advanced manufacturing.

While much change is happening, in his recent forward to the European Commission’s The Future of European Competitiveness, Mario Draghi, former European Central Bank chairman and Italian prime minster, outlined three strategic priorities to restore Europe’s long-term competitiveness and sustainable growth. Europe, he said, needs to refocus on scaling breakthrough technologies and closing the innovation gap with the U.S. and China. To combat rising energy costs and inconsistent policy execution that threatens industrial competitiveness, he urged the region to come up with a coordinated plan to ensure that climate goals reinforce—not undermine—economic growth, particularly in clean tech, manufacturing, and energy-intensive industries. Finally, given Europe is heavily dependent on external suppliers—particularly China–for critical inputs, he urged the region to strengthen its strategic autonomy and security. He called for a unified foreign economic policy that secures access to key technologies and raw materials, strengthens the defense industry, and builds Europe’s capacity to act as a cohesive economic and geopolitical power.

We welcome the support that these secular shifts bring and the challenges the region faces, however we remain focused on companies creating real value. That’s why our approach to European equities is bottom-up by design. We do not invest according to benchmark country weightings or macroeconomic views. We invest in individual businesses—backing founders, families, and management teams with clarity of vision and the capacity to lead globally. This requires deep due diligence, an appreciation for local nuance, and a commitment to long-duration thinking. It also demands an active investment approach. Europe’s opportunity set is large, but its dispersion is wide. Differentiating between durable growth franchises and structurally challenged incumbents is essential. We approach Europe not as a single investment story or a bloc but as a diverse landscape of entrepreneurial ecosystems, each producing, what we view as compelling opportunities in distinct ways.

Secular Forces Lending Support to Select Businesses

Technology and Digital Transformation

Across sectors, powerful secular trends are taking hold. In technology, Europe is building a foundation of global relevance—particularly in software, payments infrastructure, and semiconductor design. The continent’s innovation hubs—Berlin, Stockholm, Amsterdam, Helsinki—are producing a new generation of tech-enabled firms focused on financial services, cybersecurity, logistics, and enterprise SaaS. Adyen, for example, is modernizing how businesses accept payments globally, providing a unified, cloud-native platform that helps multinational retailers and ecommerce platforms optimize cost, performance, and customer experience. SAP is in the process of migrating an established and entrenched global customer base to the cloud, which will enhance its ability to innovate and deliver products that power a greater portion of its customers’ business processes.

Meanwhile, ASML and ASM International remain globally indispensable enablers of semiconductor advancement. ASML’s extreme ultraviolet (EUV) lithography machines are a cornerstone of modern chip production, while ASMI’s deposition and epitaxy are enabling a new era of chip design called “Gate All Around”-–with both businesses supported by decades of investment into research and development, unparalleled technical know-how, and monopolistic and oligopolistic positions in a mission-critical domain. In a world defined by AI, high-performance computing, and digital sovereignty, these Dutch semiconductor pioneers’ roles in the global technology stack have never been more vital.

Renewable Energy and Sustainability

Sustainability remains a deeply embedded theme in Europe’s policy and corporate landscape—not merely as a regulatory obligation, but as a strategic imperative. The EU Green Deal, Fit for 55 package, and the broader Net Zero 2050 agenda are not simply climate goals; they are industrial policy frameworks designed to mobilize capital, innovation, and competitive advantage. Looking again at Draghi’s call to action, he cautions rising energy costs and inconsistent policy execution threaten industrial competitiveness. Draghi calls for a coordinated plan to ensure that climate goals reinforce—not undermine—economic growth, particularly in clean tech, manufacturing, and energy-intensive industries. The importance placed on clean technologies has accelerated investment in renewable energy, electrification, battery storage, decarbonization, and clean transportation infrastructure. It is also catalyzing growth in related segments, such as precision agriculture, water efficiency, and circular economy solutions.

Many European companies are well-positioned to benefit. They are leaders in wind energy, building electrification systems, and green industrial automation. Moreover, many are embedding sustainability directly into their product strategy and supply chain design—meeting rising consumer and investor expectations around transparency, traceability, and carbon accountability. This is not a narrow ESG trade. It is an economic realignment that plays to Europe’s strengths in regulatory leadership, engineering expertise, and system-level design.

From Sweden’s innovative automation hubs to Norway’s cutting-edge aquaculture pens, Europe’s journey toward net zero is a story of strategic renewal. In Stockholm, Addtech’s network of 150 specialized trading companies does more than distribute components for renewable-energy projects—it aligns every product line with clear, science-based targets on emissions, biodiversity, and resource use. By treating sustainability as a growth driver rather than a cost center, Addtech has forged a blueprint for profitable decarbonization.

Further south, the Lagercrantz Group stitches together niche electrical-connection and automation businesses to accelerate Europe’s energy transition. With one or two targeted acquisitions each year, Lagercrantz enhances the renewable-energy backbone by scaling technologies that cut energy use and speed decarbonization—from smart grid connectors to solar-optimized circuitry.

In Switzerland, Sika channels sustainability into its core “Innovation & Sustainability” pillar. Every adhesive, sealant, and concrete additive plays a role in reducing a building’s overall carbon footprint. With a roadmap to slash Scope 1 and 2 internal emissions by over 50 percent by 2032 and reach full net zero by 2050, Sika turns construction materials into levers for circular, energy-efficient design across Europe.

Indoor comfort is getting its own sustainability overhaul thanks to Belimo‘s precision-engineered valves, actuators, and sensors. As heating and cooling systems decarbonize, Belimo’s RetroFIT+ program helps building owners double their avoided emissions by 2030—delivering both energy savings and better air quality with a single upgrade. Belimo is also involved in data center liquid cooling where its actuators and valves are keeping semiconductors from overheating.

And in Norway’s fjords, Salmar is rewriting the rules of aquaculture. By pioneering offshore farms, digital monitoring, and collaborative R&D through its Salmon Living Lab, Salmar reduces the biological footprint of salmon farming while meeting booming demand for healthy, traceable protein. Its model shows how consumer awareness, policy support, and corporate innovation can come together to drive sustainable growth.

Together, these five companies illustrate how Europe’s sustainability agenda has evolved from policy pronouncements into market-shaping opportunity. They treat the Green Deal not as a burden but as a blueprint for competitive advantage—powering factories, buildings, homes, and even dinner plates on the path to Net Zero 2050.

You Never Actually Own a Luxury Good …

You merely look after it for the next generation. Nowhere is Europe’s cultural, historical, and commercial distinctiveness more visible than in the luxury goods sector. Europe continues to define global luxury. From the runways of Paris to the factory floors of Modena, the continent’s high-end brands continue to compound value through scarcity, craftsmanship, and heritage.

For decades, European luxury has defined the global standard in quality, craftsmanship, and brand storytelling. Today, it remains a powerful, secular growth engine. Iconic companies, such as Hermès and Ferrari, , command global consumer loyalty across generations and geographies, built not through aggressive marketing, but through relentless dedication to heritage, scarcity, and artisanal precision. These businesses operate with enviable control over their supply chains and retail channels, reinforcing their brands’ exclusivity and pricing power.

Luxury consumption is increasingly global, increasingly digital, and increasingly resilient. Despite economic uncertainty, the world’s appetite for European luxury has remained robust—fueled by rising affluence in emerging markets, generational wealth transfer, and the expansion of experiential and status-based consumption. Importantly, the structure of the industry favors the strong. Scale allows for brand reinforcement, vertical integration, and innovation in client experience—from immersive retail to virtual fashion shows and bespoke personalization.

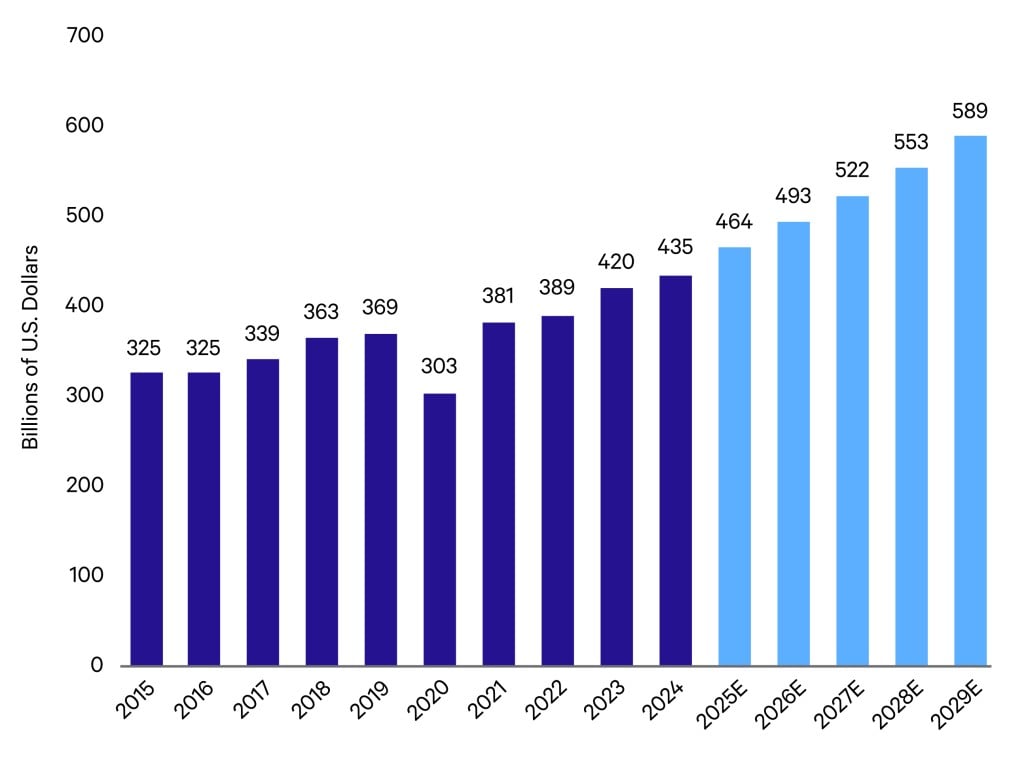

Luxury Goods Remain a Powerful Growth Engine

Ferrari provides a compelling case study. It is not merely an automotive manufacturer, but arguably the most powerful luxury brand in the world. It widely reminds: We are the competition. With production volumes deliberately capped, waiting lists measured in years, and a brand identity rooted in performance and legacy, Ferrari has mastered the art of brand scarcity. The company has demonstrated an ability to grow revenues and margins through pricing, customization, and expanded product categories—without ever compromising its elite positioning. It is a business with global reach and local roots, with years of demand visibility and strategic pricing latitude.

Similarly, Hermès represents the pinnacle of luxury execution. Its model is not based on chasing trends but on maintaining the integrity of its craftsmanship, controlling production, and fostering deep relationships with customers. Its growth has come through consistency, not reinvention—making it one of the most admired and durable businesses in global consumer markets.

In an era where brand trust, authenticity, and cultural relevance are more valuable than ever, these European houses are not just surviving—they are, in many cases outperforming in terms of growth and earnings. The combination of pricing power, emotional resonance, and global desirability makes select luxury goods businesses a durable compounder in a volatile macroeconomic landscape.

Risks to Monitor

As Draghi referenced, Europe presents a distinct set of challenges that investors should weigh carefully. At the forefront are tariffs. We don’t know what the fallout from this evolving story will be, but we will be monitoring it closely. Our six criteria naturally lead us to near monopoly businesses so the impact from competition is low and many of our businesses produce needs-oriented services (excluded from tariffs) and products that must be purchased no matter the economic backdrop.

Energy volatility remains a concern, as the region transitions away from imported fuels and toward renewables. Geopolitical tensions—ranging from the war in Ukraine and Brexit aftershocks to shifting U.S.-EU dynamics—continue to influence market sentiment. On the monetary front, persistently high inflation could prompt the European Central Bank to tighten more aggressively, pressuring valuations. Meanwhile, execution risk around EU policy initiatives—such as regulatory harmonization and energy transition—remains high. Finally, while Europe leads globally in ESG and data protection, the associated compliance burdens can be especially challenging for early-stage and growth-oriented firms.

The Bottom Line: Selective Growth in a Region of Resilience

Europe is not the next Silicon Valley—and it doesn’t need to be. We invest selectively and with conviction, one business at a time. To that end, we believe Europe has a lot to choose from. We remain focused on businesses that are redefining global industries from the ground up, looking past the macroeconomic and policy shortcomings.

For investors seeking durable growth beyond U.S. borders, select European businesses can offer a mix of structural resilience, ESG leadership, and sectoral innovation—often at a meaningful valuation discount.

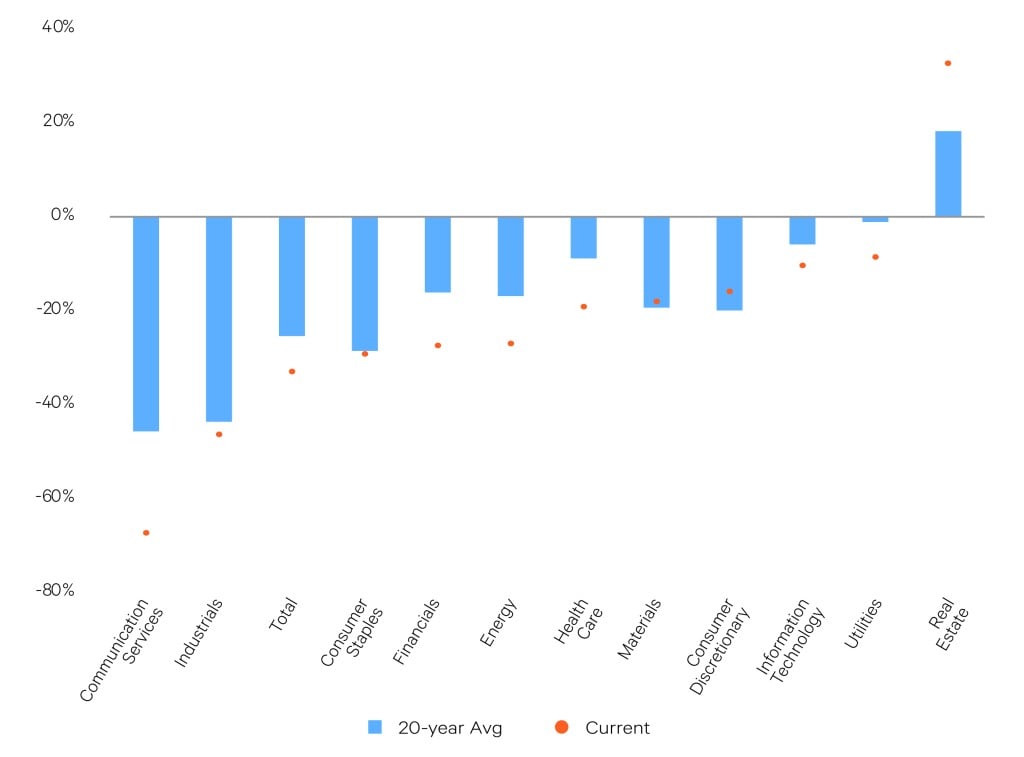

Consider that European equities have consistently traded at a valuation discount to their U.S. counterparts, with the MSCI Europe Index often carrying a price-to-earnings (P/E) multiple that is 20 percent to 30 percent lower than the S&P 500. Several factors contribute to this including sector composition, macroeconomic uncertainty, and investor preferences.

Earnings Growth versus Multiple Expansion

Broadly speaking, European equities have demonstrated what we view as stable earnings growth, with faster earnings growth in select sectors particularly in technology, healthcare, and consumer discretionary. Importantly, over the last decade, the region has benefitted far less from multiple expansion relative to U.S. equities. In our view, this creates an appealing backdrop for fundamental investors like us to identify relatively underappreciated growth opportunities.

Europe Price-to-Earnings Discount versus the United States by Sector

Selectivity Matters in a Complex Investment Universe

Navigating this market requires selectivity, patience, and local insight. The structural frictions that have long defined Europe are slowly giving way to greater integration and capital access. And as firms, such as Salmar have demonstrated, those that master Europe’s complexity can quietly, but convincingly, lead the world.

At a high level, Europe continues to face structural headwinds: fragmented capital markets, bureaucratic inertia, and uneven technology adoption remain challenges. Yet the companies that become market leaders in this environment are often those that are focused on broader trends not tied to regional economics or demographics.

We believe Europe rewards depth over breadth, conviction over coverage. This is not a market that lends itself to passive exposure or macro-driven allocation. It is a region where a concentrated, research-intensive, bottom-up strategy can thrive—if it is grounded in long-term thinking and business-focused research. The most compelling European growth stories are not defined by geography or benchmark inclusion, but by their ability to solve meaningful problems, scale globally, and adapt across market cycles.

Europe may never have the scale or uniformity of the U.S. market. But what it offers—when approached with selectivity and insight—is something equally powerful: a rich ecosystem of globally relevant businesses that combine technical excellence, sustainability leadership, and durable growth.

Disclosures:

The views expressed are the opinion of Sands Capital and are not intended as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell any securities. The views expressed were current as of the date indicated and are subject to change.

This material may contain forward-looking statements, which are subject to uncertainty and contingencies outside of Sands Capital’s control. Readers should not place undue reliance upon these forward-looking statements. There is no guarantee that Sands Capital will meet its stated goals. Past performance is not indicative of future results.

All investments are subject to market risk, including the possible loss of principal. Recent tariff announcements may add to this risk, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional and economic developments. Investments in emerging markets are subject to abrupt and severe price declines. The economic and political structures of developing nations, in most cases, do not compare favorably with the United States or other developed countries in terms of wealth and stability, and their financial markets often lack liquidity. Because of this concentration in rapidly developing economies in a limited geographic area, the strategy involves a high degree of risk. In addition, the strategy is concentrated in a limited number of holdings. As a result, poor performance by a single large holding of the strategy would adversely affect its performance more than if the strategy were invested in a larger number of companies. The strategy’s growth investing style may become out of favor, which may result in periods of underperformance.

Differences in account size, timing of transactions, and market conditions prevailing at the time of investment may lead to different results, and clients may lose money. A company’s fundamentals or earnings growth is no guarantee that its share price will increase. Forward earnings projections are not predictors of stock price or investment performance, and do not represent past performance. Characteristics, sector (and regional, country, and industry, where applicable) exposure, and holdings information are subject to change and should not be considered as recommendations.

The specific securities identified and described do not represent all of the securities purchased, sold, or recommended for advisory clients. There is no assurance that any securities discussed will remain in the portfolio or that securities sold have not been repurchased. You should not assume that any investment is or will be profitable. A full list of public portfolio holdings, including their purchase dates, is available here.

As of May 7, 2025, Addtech, Adyen, ASM International, ASML, Ferrari, Hermès, and Sika were held across Sands Capital strategies. The companies represent the largest European positions in financials, industrials, information technology, luxury goods, materials, and Belimo, Lagercrantz, Salmar, SAP, represent European companies most recently added to the portfolios. They were selected by the author on an objective basis to illustrate the secular trends discussed and views expressed in the commentary.

The MSCI Europe Index captures large and mid-cap representation across Developed Markets (DM) countries in Europe. The index covers approximately 85 percent of the free float-adjusted market capitalization across the European Developed Markets equity universe. *DM countries in the MSCI EAFE Index include Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the UK. EM countries include Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

The S&P 500 Total Return Index measures the performance of the largest 500 U.S. companies by market capitalization.

References to “we,” “us,” “our,” and “Sands Capital” refer collectively to Sands Capital Management, LLC, which provides investment advisory services with respect to Sands Capital’s public market investment strategies, and Sands Capital Alternatives, LLC, which provides investment advisory services with respect to Sands Capital’s private market investment strategies, which are available only to qualified investors. As the context requires, the term “Sands Capital” may refer to such entities individually or collectively. As of October 1, 2021, the firm was redefined to be the combination of Sands Capital Management, LLC and Sands Capital Alternatives, LLC (previously known as Sands Capital Ventures, LLC). The two investment advisers are combined to be one firm and are doing business as Sands Capital. Sands Capital operates as a distinct business organization, retains discretion over the assets between the two registered investment advisers, and has autonomy over the total investment decision-making process.

Information contained herein may be based on, or derived from, information provided by third parties. The accuracy of such information has not been independently verified and cannot be guaranteed. The information in this document speaks as of the date of this document or such earlier date as set out herein or as the context may require and may be subject to updating, completion, revision, and amendment. There will be no obligation to update any of the information or correct any inaccuracies contained herein.

Recent tariff announcements may add to this volatility, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. You should consider these factors when making investment decisions.

Notice for non-US Investors.